Business Contracts: The Ultimate Guide

Whatever line of work you’re in, you’ll need to use business contracts to formalize the terms of your agreements with outside vendors as well as internal employees. These legal documents not only formalize agreements between parties but also safeguard your interests and lay the foundation for healthy business relationships.

This comprehensive guide delves into what business contracts are, their roles in various industries, and the nuances of crafting effective agreements. We’ll explore different types of business contracts, with practical examples to illustrate their application in real-world scenarios, from service agreements to intellectual property licensing.

In addition to providing definitions and examples, we’ll also guide you through the key sections and common clauses of business contracts. And we’ll share practical tips and best practices to ensure that your contracts not only comply with legal standards but also align perfectly with your business objectives.

What is a business contract?

A business contract is a legally binding agreement between two parties that outlines the terms and conditions for the exchange of goods or services. In business deals, a well-written contract ensures that everyone involved is on the same page. In essence, being “legally binding” means that the law recognizes and can enforce the agreement, providing a safety net for all parties involved.

Think of a business contract as a roadmap that guides the way business is conducted. It clearly outlines the obligations, expectations, and responsibilities of each party. By putting terms and conditions in writing, a business contract creates a shared understanding that helps prevent issues. Modern contract tracking systems make it easier to monitor these obligations throughout the contract lifecycle.

But a business agreement is more than just a piece of paper (or a digital contract) containing legal jargon. It’s a reflection of mutual consent, where each party agrees to hold up their end of the deal. This mutual agreement is crucial in building trust and reliability, which are the cornerstones of any strong business relationship. Organizations managing multiple agreements often implement SaaS contract management solutions to streamline their processes.

Why are contracts important for businesses?

Contracts are important for businesses because they provide protection for all parties, and define the scope and timeline of a commercial arrangement.

In particular, business contracts do all the following:

- Provide legal protection

- Clarify responsibilities

- Ensure payment

- Regulate quality of work

- Set timelines

- Foster business relationships

Below is a detailed list of the ways contracts are important in business relationships:

Providing legal protection

First and foremost, contracts act as a shield against legal complications. By clearly outlining each party’s obligations, they provide a solid ground to stand on if disputes arise. If a party fails to meet their commitments, a contract offers a legal framework for seeking reparation. This legal protection is invaluable, giving you peace of mind as you conduct your business. Contract management security plays a vital role in protecting these important documents from unauthorized access or tampering.

Clarifying responsibilities

Contracts eliminate guesswork by explicitly stating duties, deadlines, and expectations. This level of clarity ensures that everyone involved understands their roles, paving the way for smoother operations and fewer misunderstandings. It’s all about setting clear boundaries and guidelines, which can significantly improve efficiency and productivity. Many businesses use contract reminder software to stay on top of these responsibilities and deadlines.

Ensuring payment

In the world of business, financial clarity is crucial. Contracts specify payment terms, safeguarding both parties from potential financial disputes. They lay out how, when, and under what conditions payments should be made, ensuring that you are compensated for your services and that your clients or partners receive their money’s worth. Contract management reporting tools help organizations track payment schedules and financial obligations across all their agreements.

Regulating quality of work

A well-drafted contract often includes clauses that set the standard for the quality of work expected. These benchmarks are not just about maintaining standards; they provide a measurable way to assess performance, ensuring that the end product or service meets agreed-upon criteria. Contract compliance audit processes help verify that these quality standards are being met throughout the contract term.

Setting timelines

Time is of the essence in business, and contracts help in managing it effectively. By stating when specific tasks or objectives should be accomplished, contracts reduce the risk of delays and the misunderstandings that often accompany them. A well-designed contract workflow ensures that all parties stay aligned on timing and milestones.

Fostering business relationships

Lastly, the very act of agreeing to a contract can lay the foundation for a strong, long-term business relationship. It establishes trust and sets clear terms from the outset, paving the way for future collaboration. Legal operations software helps teams manage these relationships efficiently across the entire organization.

In short, business contracts keep you and the other party on the same page throughout an entire project, making sure expectations are aligned and everyone gets what they need.

What are the types of contracts in business?

The most common 25 types of contracts in business are:

- Service agreements

- Sale of goods

- Employment contracts

- Independent contractor agreements

- Non-disclosure agreements (NDAs)

- Master service agreements (MSAs)

- Real estate contracts

- Memorandum of understanding

- Joint venture and partnership contracts

- Non-compete agreements

- Licensing agreements

- Franchise agreements

- Purchase orders

- Distribution agreements

- Consulting agreements

- Lease agreements

- Agency agreements

- Advertising agreements

- Confidentiality agreements

- Supply contracts

- Maintenance contracts

- Loan agreements

- Brokerage agreements

- Shareholder agreements

- Subscription agreements

Below is a detailed list explaining the most common types of business contracts.

1. Service agreements

Service agreements define the scope of work and payment terms for services offered. For example, a marketing agency might sign a service agreement with a client to provide SEO services for six months. Modern OCR contract management systems can automatically extract and categorize key terms from these agreements.

2. Sale of goods

Sales contracts are often governed by the Uniform Commercial Code, and deal with the sale and purchase of physical products. For example, a retailer might contract with a supplier to purchase 1,000 units of a specific item. Sales contract automation tools can streamline the creation and execution of these high-volume agreements.

3. Employment contracts

A staple in the corporate world, these detail the terms of an individual’s employment, including responsibilities, salary, and benefits. They provide clarity and security for both the employer and the employee.

4. Independent contractor agreements

Ideal for freelance and project-based work, these agreements differ from employment contracts as they usually don’t include employee benefits. They’re used for hiring individuals like graphic designers or consultants for specific tasks.

5. Non-disclosure agreements (NDAs)

Essential for protecting sensitive information, NDAs ensure that employees or partners do not disclose proprietary or confidential information. An effective agreement approval workflow ensures these critical documents are reviewed by the right stakeholders before execution.

6. Master service agreements (MSAs)

These set the general terms between parties for multiple projects or transactions, defining terms like confidentiality, payment, and dispute resolution. Organizations often use the most efficient CLM for handling vendor agreements to manage these complex relationships.

7. Real estate contracts

These involve transactions related to property, including buying, selling, or leasing. They encompass various agreements, from commercial leases to property sales. Contract renewal reminder software is particularly useful for managing lease expirations and renewal opportunities.

8. Memorandum of understanding

While not legally binding, these documents outline the terms of a preliminary agreement and often serve as a precursor to a formal contract.

9. Joint venture and partnership contracts

Used when multiple parties, like businesses or individuals, come together for a joint project or partnership. These agreements define the roles, contributions, and sharing of profits or losses among the parties.

10. Non-compete agreements

These prevent employees or business partners from starting or joining competing businesses within a specified area and time frame after leaving a company.

11. Licensing agreements

Focused on intellectual property, these contracts allow one party to use another’s intellectual property, like software, under agreed terms.

12. Franchise agreements

These allow individuals to operate a business under a larger company’s brand and business model, detailing terms like royalties, marketing, and operational guidelines.

13. Purchase orders

Procurement contracts are common in supply chain negotiations, where they outline specific terms for the purchase of goods, including quantities, specifications, and delivery dates.

14. Distribution agreements

Used by manufacturers and distributors, these define the terms for distributing products, including territories, sales targets, and marketing responsibilities.

15. Consulting agreements

Crafted for expert advice or services, these agreements detail the nature of the consulting work, duration, payment terms, and confidentiality clauses.

16. Lease agreements

Used for renting equipment or property, detailing the lease terms, payments, maintenance responsibilities, and duration.

17. Agency agreements

Where one party acts on behalf of another, particularly in sales or representation. They outline the agent’s authority, commission rates, and performance expectations.

18. Advertising agreements

Essential for marketing campaigns, they define the scope, duration, and terms of advertising services, including deliverables and payment terms.

19. Confidentiality agreements

Similar to NDAs but broader in scope, they protect sensitive information in various business dealings, ensuring that confidential data remains secure.

20. Supply contracts

These govern the regular supply of goods or materials, specifying quantities, delivery schedules, quality standards, and pricing.

21. Maintenance contracts

Crucial for regular upkeep of equipment or property, detailing the frequency, scope, payment terms, and standards of the maintenance services provided.

22. Loan agreements

Detailing the terms of a loan between two parties, including the loan amount, interest rate, repayment schedule, and collateral, if applicable.

23. Brokerage agreements

Used in financial and real estate sectors, outlining the terms under which a broker will act on behalf of a client, including commissions and services provided.

24. Shareholder agreements

In companies with multiple shareholders, these define the rights, responsibilities, and obligations of each shareholder, including voting rights and dividend distribution.

25. Subscription agreements

Used by companies raising capital, where investors agree to buy shares at a specific price, including terms of the investment and investor rights.

When choosing which type of contract to use for a particular project, take a look at existing templates to make sure the agreement’s structure and terms suit your requirements. Then you can customize the language of each agreement to suit the needs of the project. Contract management dashboard examples can help you visualize how different contract types perform across your organization.

Common clauses in business contracts

Business contracts often include specific clauses designed to protect both parties and add layers of legal safety and clarity.

Common contract clauses in business agreements include the following:

- Indemnification clause

- Limitation of liability clause

- Force majeure clause

- Entire agreement clause

- Severability clause

- Confidentiality clause

- Non-compete clause

- Arbitration clause

- Termination clause

- Jurisdiction clause

- Payment terms

- Renewal clause

- Subcontracting clause

- Change of control clause

- Integration clause

- Dispute resolution clause

- Notice clause

Here’s an overview of these common business contract clauses.

1. Indemnification clause

This clause requires one party to compensate the other for certain losses or damages. It’s crucial for managing contract risks and liabilities, especially in industries where there’s a higher potential for loss or damage.

2. Limitation of liability clause

Such a clause limits the amount one party has to pay the other if something goes wrong. It’s a way of managing risk and is often negotiated based on the scope and nature of the contract.

3. Force majeure clause

This provision frees both parties from liability or obligation when an extraordinary event or circumstance beyond their control, such as a natural disaster, war, or pandemic, prevents one or both parties from fulfilling their contractual obligations.

4. Entire agreement clause

This clause states that the written contract represents the full agreement between the parties and supersedes all prior negotiations, promises, or agreements. It ensures that only the terms within the contract are legally binding.

5. Severability clause

A severability clause allows the remainder of the contract to remain valid and enforceable, even if one part of the contract is found to be invalid or unenforceable. This helps preserve the intent of the agreement as much as possible.

6. Confidentiality clause

This clause obligates the parties to keep certain information confidential. It’s vital in protecting trade secrets and sensitive business information.

7. Non-compete clause

This clause prevents one party, typically the employee, from entering into or starting a similar profession or trade in competition against the employer.

8. Arbitration clause

This provision requires the parties to resolve disputes through arbitration rather than through the court system. It can expedite dispute resolution and reduce legal costs.

9. Termination clause

This specifies the conditions under which the contract may be terminated. It outlines the process for ending the agreement and the consequences for premature termination.

10. Jurisdiction clause

This clause identifies the location and legal system that will govern the contract. It’s crucial for contracts between parties in different legal jurisdictions.

11. Payment terms

This section details the payment obligations, including amounts, deadlines, and methods of payment. It helps prevent disputes over financial matters.

12. Renewal clause

This clause outlines the conditions under which the contract can be renewed. It’s especially important for long-term agreements or ongoing business relationships.

13. Subcontracting clause

This clause controls whether and how a party can subcontract some of its duties under the contract. It’s significant in projects that involve multiple layers of contributors.

14. Change of control clause

This provision addresses how the contract is affected if there’s a significant change in the ownership or control of one of the parties.

15. Integration clause

Similar to the entire agreement clause, it states that the written contract is the final and complete agreement between the parties, superseding all prior discussions.

16. Dispute resolution clause

Beyond arbitration, this may include mediation or other forms of dispute resolution and the steps parties must follow in the event of a dispute.

17. Notice clause

This clause dictates how all communications, legal notices, and other correspondence should be delivered among the parties.

Including several of these clauses in a business contract (and in your contract management software’s clause library), as appropriate, can significantly reduce legal risks. Clauses like these help ensure that the agreement is fair and enforceable, and also serve as tools to help you manage expectations and clarify obligations. In all these ways, contract clauses provide a roadmap for resolving issues that may arise during the life of the agreement.

How to write a business contract

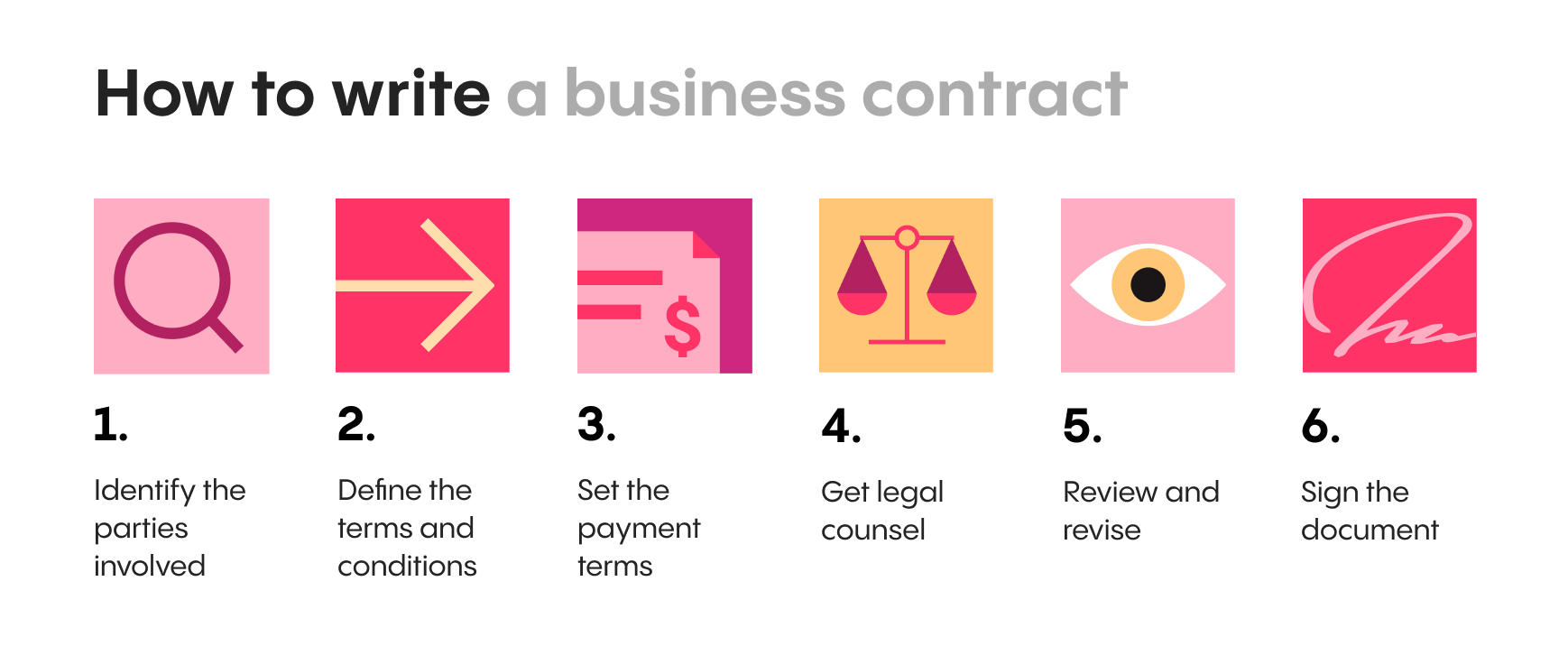

Writing a business contract involves the following seven steps:

- Identify the parties involved

- Define the terms and conditions

- Set the payment terms

- Get legal counsel

- Review and revise

- Sign the document

Now let’s explore each of these steps in greater detail.

1. Identify the parties involved

Start by clearly naming all parties involved in the contract. Use full legal names and addresses to eliminate contract ambiguity. This clarity is crucial for enforceability, ensuring the law can appropriately hold each party accountable.

2. Define the terms and conditions

This section is the heart of your contract. Outline the obligations, responsibilities, and expectations for all parties in clear, unambiguous language. Include specifics on the scope of work, deliverables, deadlines, and any performance standards or criteria. The more detailed this section is, the less room there is for misunderstandings.

3. Set the payment terms

Clearly indicate how, when, and under what conditions payments will be made. This should cover payment schedules, acceptable payment methods, and penalties, if any, for late payments. This clarity is essential for financial stability and trust.

4. Get legal counsel

Ensure that your contract adheres to applicable laws and regulations. This might involve state law, federal regulations, or industry-specific legal requirements. Consulting a legal professional can help ensure that your contract is compliant and enforceable – and can help you maintain contract compliance, too.

5. Review and revise

Encourage all parties to thoroughly review the contract. Open negotiation and discussion can lead to revisions that make the contract more balanced and satisfactory for everyone involved. This collaborative approach fosters mutual understanding and respect.

6. Sign the document

Once all parties agree to the terms, it’s time to make it official. Sign the contract using contract management software or another electronic signature tool, and make sure each party receives a copy for their records. Keep a copy in your own contract database, too.

By following these steps in your contract workflows, you’ll create a robust business contract that serves as a strong legal foundation for a deal. Always make sure you understand the terms fully before signing.

Conclusion: Business contracts keep all parties safe

Whether it’s a service agreement, a real estate transaction, or an agreement to protect trade secrets, always make sure both parties fully understand the terms and conditions of a contract before signing. Follow the guidelines above, and you’ll be able to draft and execute contracts that safeguard your business’s interests, while also protecting the rights of other parties.

Remember, the key to a successful business contract lies not just in its legal soundness but also in its ability to reflect mutual understanding and agreement. It’s about balancing protection with practicality, and ensuring that all parties feel secure and valued.

As you move forward in your business journey, let these insights into business contracts be your guide. Whether you’re a small business owner or part of a larger corporation, understanding and utilizing effective contracts is instrumental in navigating the commercial landscape successfully – and keeping your relationships grounded in mutual respect and legal integrity.