Electronic Signature Formats and Examples

Table of contents

- Understanding the electronic signature landscape in May 2025

- The economic impact of electronic signatures

- The four main electronic signature formats

- Advanced electronic signature technologies

- Legal foundations of electronic signatures

- Audit trails and legal admissibility

- Electronic signature implementation best practices

- ROI of electronic signature implementation

- Frequently asked questions about electronic signature types

- Conclusion: Embracing the electronic signature revolution

Understanding the electronic signature landscape in May 2025

In today’s digital environment, adopting electronic signatures isn’t just convenient—it’s essential for business competitiveness. The United States’ ESIGN Act (Electronic Signatures in Global and National Commerce Act) and the Uniform Electronic Transactions Act (UETA) have established the solid legal foundation for electronic signatures, with comparable legislation implemented globally.

As President Bill Clinton stated when signing the ESIGN Act in 2000, “Contracts established on the Internet will now have the same legal force as the equivalent contracts on paper.” This fundamental shift has revolutionized how businesses approach agreement processes, eliminating traditional paper-based constraints while creating new possibilities for contract management software with AI Copilot features.

According to a 2024 industry study, “Businesses that implement electronic signatures have an 85% increase in efficiency,” demonstrating the transformative impact these technologies deliver across organizations of all sizes.

The economic impact of electronic signatures

The adoption of electronic signatures delivers substantial return on investment. Research shows that “Almost 81% of e-signature business users achieved ROI within a single 12-month budget cycle. Interestingly, around 25% of the users achieved ROI in three months or even earlier.”

These impressive returns come from multiple sources, as documented in various research studies:

| Benefit | Improvement | Source |

|---|---|---|

| Contract completion time | 83% faster | Aberdeen Group |

| Document error rate | 55% lower | Aberdeen Group |

| Operational costs | 37% reduced | Aberdeen Group |

| Customer satisfaction | 28% higher | Aberdeen Group |

| Processing errors | 90% reduced | LunarPen |

| Administrative hours saved | 300 per month (average) | DocuSign |

| Agreements completed in <1 day | 80% | DrySign |

A real-world example demonstrates these impacts clearly: “United Healthcare executed a provider contract in 2 days as compared to the usual 32.5 days. United Healthcare saved around 3.5 million pages through the implementation of e-signature solutions. The annual admin savings for United Healthcare were $1 million that accounts for the annual salary of almost 31 admins.”

This evolution reflects broader changes in how we conceptualize trust and verification in digital environments, moving from physical presence to multi-factor digital authentication systems that often provide greater security than traditional methods. Organizations leveraging contract tracking capabilities can monitor signature completion rates and identify bottlenecks in their approval processes.

The four main electronic signature formats

Electronic signatures have introduced unprecedented flexibility and accessibility compared to traditional ink signatures. However, significant differences exist between the main formats, each designed for specific contexts and offering varying levels of security, validity, and convenience.

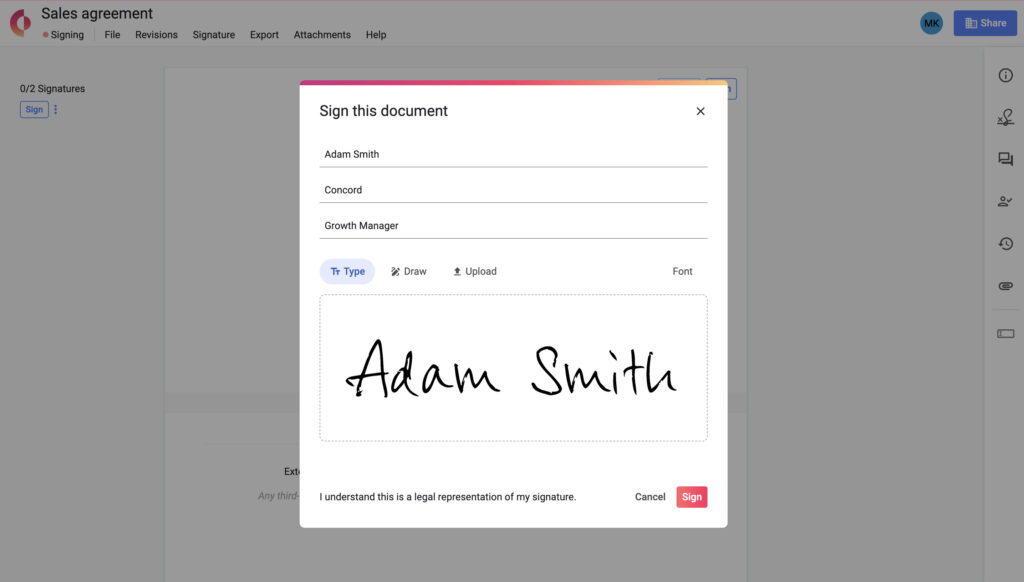

Format 1: Typewritten e-signatures

Typewritten electronic signatures allow signers to type their name onto a signature line within digital documents, indicating their approval or consent. Despite their simplicity, these signatures are legally binding under many regulations, including the Uniform Electronic Transactions Act, offering an efficient alternative when physical presence isn’t possible.

This format has become particularly valuable for organizations implementing contract lifecycle management software solutions, as it streamlines the signing process while maintaining legal validity. Modern contract repository software typically includes typewritten signature capabilities as a standard feature, especially when integrated with agreement approval workflow processes.

According to Lightico research, “transactions done using electronic signatures have skyrocketed to $754 million within the last five years from $89 million.” This dramatic increase demonstrates the growing business confidence in typewritten signatures as a legally valid method for executing agreements.

Format 2: Scanned image signatures

The scanned image format involves a signer signing on paper, scanning the signed document, and then attaching it to an electronic document. While slightly more time-consuming than other methods, it resembles a traditional handwritten signature, which can be preferable in certain scenarios.

For instance, when signing a contract managment software agreement remotely, you might sign your name on a blank piece of paper, scan it using a smartphone app, and then upload the scanned image to the electronic document. This method retains the personal touch of a traditional signature while providing digital convenience. Modern OCR contract management systems can extract and digitize these scanned signatures for better searchability and compliance tracking.

This hybrid approach is often used in healthcare implementations, where some stakeholders may prefer the familiarity of handwritten signatures while still benefiting from digital document management and contract compliance audit capabilities.

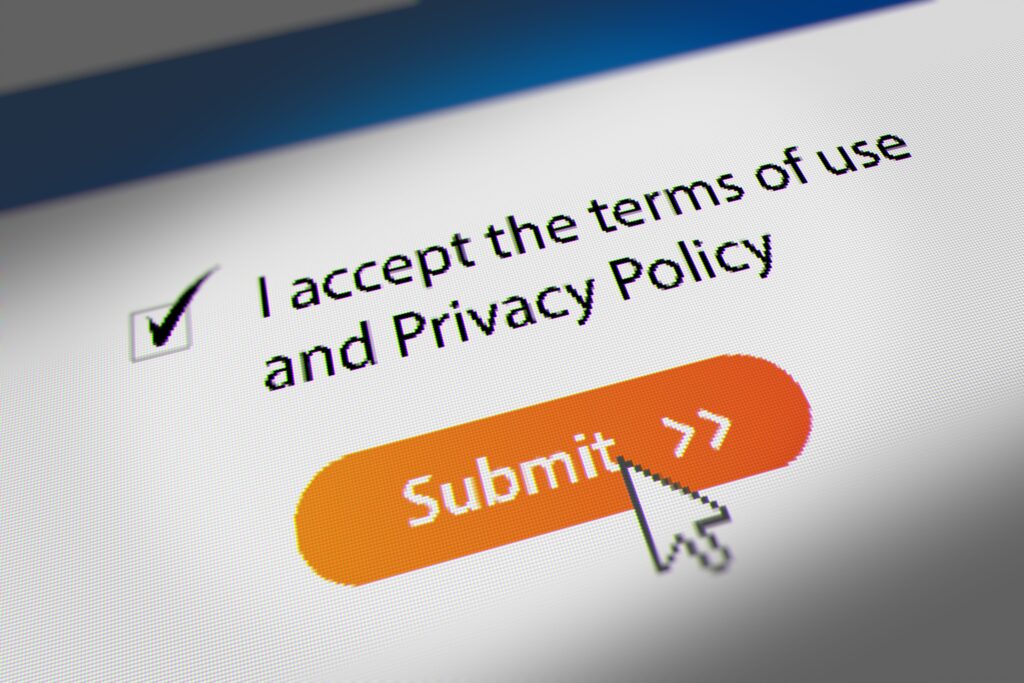

Format 3: Clickwrap signatures

For anyone who has ever clicked an “I Agree” button or ticked a checkbox on an online form, you’ve used a clickwrap signature. This electronic signature format is popular in online agreements due to its simplicity and ease of implementation on digital platforms.

This clear legal recognition makes clickwrap signatures particularly valuable for SaaS contract management implementations where user agreements need to be executed quickly at scale.

Format 4: Digitized signature pad

Using a digitized signature pad, the signer physically signs on a digital device, and this signature is then captured and embedded in the document. This format provides an enhanced level of authenticity and security because it involves unique biometrics of the signer.

This method is commonly used in healthcare settings where doctors often use a digitized signature pad for signing electronic medical records and legal contract management software systems. When prescribing medication or submitting medical notes, the doctor signs using a stylus on a digitized pad, with the signature then captured and attached to the electronic document. This approach integrates seamlessly with contract workflow automation to ensure proper routing and approvals.

Advanced electronic signature technologies

Beyond these four basic formats, advanced electronic signature technologies provide enhanced security and verification capabilities.

Digital signatures

A digital signature differs from a basic electronic signature as it uses cryptography for enhanced security. As explained by DigiCert, “A digital signature ensures that a document cannot be changed without invalidating the signature, thus adding in higher security to an electronic signature and allowing digitally signed documents to be legally binding.”

Digital signatures involve a signer’s private key, known only to them, which is used to encrypt data. The recipient uses the public key in the signer’s digital certificate to decrypt the data, thus verifying its authenticity. If the information is successfully decrypted, it validates both the signature and document integrity. These advanced signatures are crucial for maintaining contract management security in high-stakes agreements.

These advanced signatures are particularly important in regulated industries and for high-value transactions. As noted by DigiCert, “You should use a digital signature when you need more security — for example, for legal, healthcare or HR documents.”

Qualified electronic signatures (QES)

Within the European Union’s eIDAS framework, Qualified Electronic Signatures provide the highest legal backing. According to Dropbox Sign, “QES are created using a qualified electronic signature creation device that meets specific technical and legal requirements. They are also issued by a trusted third-party certification authority, which verifies the signer’s identity and ensures compliance with regulatory standards.”

Organizations seeking the most efficient CLM for handling vendor agreements often prioritize platforms with QES support for international operations.

Legal foundations of electronic signatures

The legal validity of electronic signatures is well-established across most jurisdictions, though specific requirements may vary. In the United States, two key pieces of legislation form the foundation:

ESIGN Act

The Electronic Signatures in Global and National Commerce Act (ESIGN) was signed into federal law in 2000. According to Adobe, “The U.S. Electronic Signatures in Global and National Commerce (ESIGN) Act in 2000 legislated that electronic signatures are legal in every state and U.S. territory where federal law applies.”

The ESIGN Act provides rules governing the validity of electronic signatures and records for transactions affecting interstate or foreign commerce and was passed to “resolve disputes between different state laws and standardize the approach to electronic records and signatures in interstate and international commerce.”

Uniform Electronic Transactions Act (UETA)

The UETA, developed by the Uniform Law Commission in 1999, has been adopted by 49 U.S. states (with New York being the exception).

For an electronic signature to be legally binding under these frameworks, it must meet several requirements:

- Intent to sign – The signer must demonstrate clear intent to sign the document electronically

- Consent to do business electronically – All parties must agree to conduct business using electronic methods

- Association of signature with the record – The system must create and maintain evidence of the signing process

- Record retention – Electronic records must be maintained and accessible to all relevant parties

Audit trails and legal admissibility

When implementing any electronic signature solution, maintaining comprehensive audit trails is essential for ensuring legal admissibility. As noted by attorney Tyler Newby in a Fenwick analysis of court cases, “a U.S. district court in the Southern District of New York, found that an e-signature provider’s ‘time-stamped audit trail that tracks—using IP addresses and other identifying data—when each [signatory] receives, views and executes each agreement’ was sufficient to establish that the signer’s signature was his own.”

Leading contract analytics software solutions include robust audit trail capabilities that record:

- Complete timestamps of all document activities (viewing, signing, declining)

- IP addresses and geolocation data

- Email verification records

- Authentication methods used

- Document access records

These audit trails have proven decisive in multiple court cases where electronic signatures were challenged, including IO Moonwalkers, Inc. v. Banc of America (2018) and Obi v. Exeter Health Resources, Inc. (2019), where comprehensive electronic records effectively countered claims of forged signatures.

Modern contract management reporting tools can analyze these audit trails to identify patterns and potential compliance issues, while contract management dashboard examples demonstrate how to visualize signature completion metrics effectively.

Electronic signature implementation best practices

Based on industry research and legal precedents, here are key implementation best practices for ensuring your electronic signatures remain legally valid and secure:

1. Authentication methodologies

Implement multiple authentication methods based on the risk profile of your agreements:

- Email verification

- SMS one-time passwords

- Knowledge-based authentication

- ID verification for high-value transactions

2. Clear consent procedures

Document explicit consent to use electronic signatures by:

- Including clear consent language before signature fields

- Maintaining records of consent acknowledgments

- Providing alternatives for those who cannot or choose not to sign electronically

3. Comprehensive audit trails

Ensure your best contract lifecycle management software solution maintains detailed audit trails including:

- IP addresses and timestamps

- All document actions (sending, viewing, signing)

- Authentication methods used

- Copies of all communications

- Document version history

Modern legal operations software can help automate the collection and organization of these audit trail elements for better compliance management.

4. Security measures

Implement robust security protocols:

- Encrypt documents in transit and at rest

- Use SSL/TLS for all communications

- Implement access controls and permissions

- Regularly audit security measures

- Comply with relevant data protection regulations

5. Document retention

Establish clear document retention policies:

- Store electronically signed documents in secure repositories

- Ensure access for all authorized parties

- Implement appropriate retention periods

- Include metadata and audit trails with archived documents

For contracts with renewal clauses, contract renewal reminder software can ensure timely review and re-execution of agreements before they expire.

ROI of electronic signature implementation

The return on investment from electronic signature implementation is well-documented and substantial. According to research published by Webinarcare, “81% of company users of electronic signatures report a ROI within a 12-month budget cycle, while 25% report a ROI within three months or sooner.”

These financial benefits come from multiple sources:

- Time savings: “Businesses achieve 70% to 80% efficiency improvements after removing manual processes to adopt digital technologies like e-signature solutions.”

- Error reduction: “Businesses that go paperless reduce their processing errors by an average of 90%.”

- Contract turnaround: “With eSignature, up to 80% of agreements are completed in less than a day and 44% in less than 15 minutes, organically driving ROI.”

- Document security: “Among surveyed e-signature users, 58% experienced an increase in data and document security.”

Organizations can further amplify these benefits by implementing sales contract automation, which combines electronic signatures with automated workflows to accelerate the entire sales cycle.

Frequently asked questions about electronic signature types

Are electronic signatures legally binding?

Yes, electronic signatures are legally binding in most jurisdictions. In the United States, the ESIGN Act and UETA establish the legal validity of electronic signatures. According to DocuSign, “E-signatures are valid in all U.S. states and are granted the same legal status as handwritten signatures under state laws.”

What types of documents can be signed electronically?

Most business and personal documents can be signed electronically, including:

– Sales proposals and quotes

– Employment documents

– Non-disclosure agreements

– Purchase orders

– Service agreements

However, certain document types are often excluded from electronic signature laws, including:

– Wills, codicils, and testamentary trusts

– Family law documents (adoption, divorce)

– Court documents

– Certain government filings

What should I look for in an electronic signature solution?

When evaluating electronic signature solutions, key features to consider include:

– Legal compliance with relevant regulations (ESIGN, UETA, eIDAS)

– Security features (encryption, authentication options)

– Audit trail capabilities

– Integration with existing systems

– User experience and ease of use

– Mobile accessibility

– Template management

– Document storage and retrieval

– Cost and ROI potential

Consider scheduling a contract management software demo to evaluate these features in action.

How do electronic signatures hold up in court?

Electronic signatures have consistently been upheld in courts when properly implemented. Key factors that courts examine include:

– Evidence of the signer’s intent

– Proof of the signer’s identity

– Integrity of the signed document

– Comprehensive audit trails

– Compliance with relevant laws

According to an analysis of court cases by Fenwick & West LLP, “In IO Moonwalkers, Inc. v. Banc of America, 814 S.E.2d 583 (N.C. Ct. App. 2018), a DocuSign eSignature audit trail showed that a business accessed a document it claimed it had not signed, which supported the trial court’s finding that the business had ratified the signature of the agreement with the other party.”

Similar results have been seen in multiple court cases, with electronic signatures being upheld when backed by solid audit trails and proper authentication.

What’s the difference between electronic signatures and digital signatures?

While often used interchangeably, these terms have distinct meanings:

Electronic signatures are broadly defined as any electronic sound, symbol, or process attached to a document indicating acceptance. This includes typed names, clicked checkboxes, or scanned signatures.

Digital signatures are a specific type of electronic signature that uses cryptographic technology to provide enhanced security. As DigiCert explains, “A digital signature ensures that a document cannot be changed without invalidating the signature, thus adding in higher security to an electronic signature.”

Digital signatures provide additional verification through encryption and are often required for higher-security applications or in certain regulated industries.

Conclusion: Embracing the electronic signature revolution

The evolution of signature verification from ink and paper to sophisticated electronic formats represents one of the most significant transformations in business operations in recent decades. As organizations continue to digitize their processes, electronic signatures have moved from novel technology to essential business tool.

The legal foundation for electronic signatures is well-established, with courts consistently upholding their validity when properly implemented. By understanding the various electronic signature formats and implementing best practices for authentication, consent, and record-keeping, organizations can confidently embrace this technology.

Most importantly, the ROI of electronic signature implementation is clear and substantial. From faster transaction times to reduced errors, lower costs, and improved security, the benefits extend across virtually every aspect of document management and business operations.

Ready to explore how electronic signatures can transform your document workflows? Request a demonstration of Concord’s comprehensive agreement management platform today.