Contract Compliance Management Software: Concord

Automate compliance tracking, centralize your agreements, and proactively manage risks—all from one intuitive platform

- Stay audit-ready with automated compliance tracking

- Reduce compliance risks by centralizing every contract

- Simplify reporting with secure, instant document access

“Concord is my one-stop shop for the entire contract lifecycle. It’s Google docs, Microsoft Word, DocuSign and a File explorer, all in one.”

Hannah L., ⭐⭐⭐⭐⭐

Book a demo

What is Contract Compliance Management Software?

Contract compliance management software is a technology solution that automates the monitoring, tracking, and enforcement of contractual obligations to ensure all parties meet their agreed-upon terms and conditions. Concord’s compliance management software uses AI and automation to extract obligations from contracts, track performance against requirements, and alert stakeholders to potential compliance issues before they escalate.

Organizations use Concord’s contract compliance management software to:

- Reduce contract value leakage by up to 9.2%

- Automate obligation tracking and deadline monitoring

- Minimize regulatory penalties and compliance risks

- Improve supplier performance and accountability

- Create audit trails for regulatory inspections

Table of Contents

Real-world impact: Case studies in contract compliance management

Case Study: AI Simplifies Contracting and Renewals at Vecna Robotics

Key Benefits:

- • AI-powered data extraction

- • Proactive renewal alerts

- • Centralized repository

Vecna Robotics' manual contract management across disparate systems created compliance risks and inefficiencies. Tracking deadlines and data was a constant struggle.

How Concord helped:

- • Concord's AI automatically captures lifecycle dates

- • Automated alerts prevent costly auto-renewals

- • One-click document creation with AI

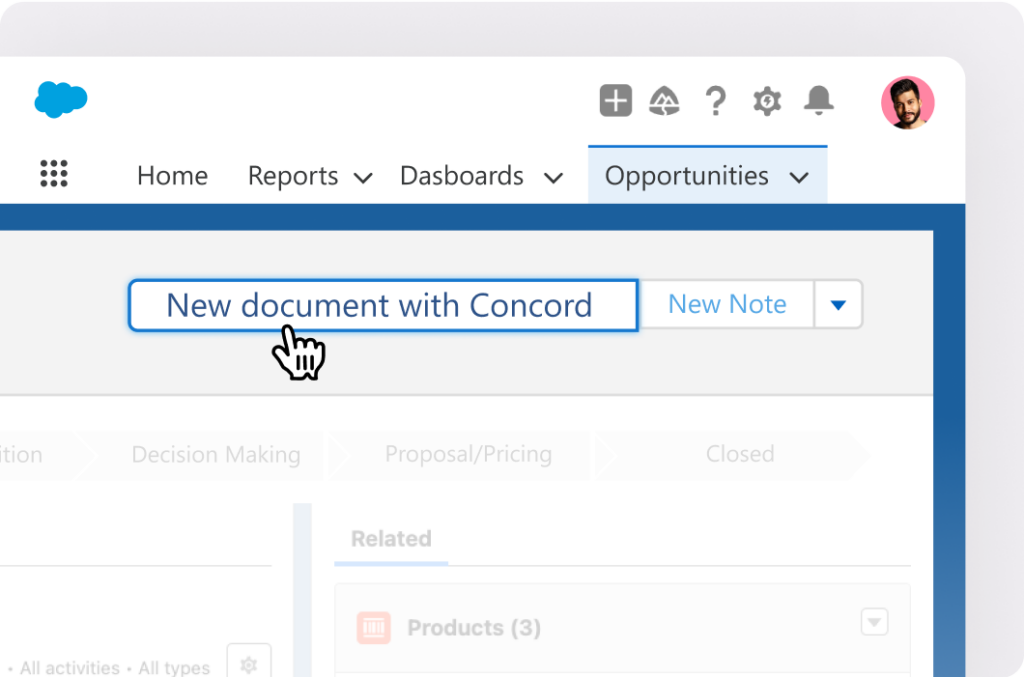

"I used to spend lots of time on this, but now I just hit 'create document' because Concord's AI does a great job automatically. Concord has made the whole process simpler — and saved us money, too." — Michael Bearman, Chief Legal & Safety Officer

Case Study: Centralizing Contract Workflows Improves Collaboration at Follett Learning

Key Benefits:

- • Subsidiary functionality

- • Centralized oversight

- • Flexible workflows

Follett Learning's decentralized manual contract processes created visibility issues and inefficiencies. Teams struggled to locate agreements and track key terms across departments.

How Concord helped:

- • Concord's subsidiaries let departments maintain autonomy

- • Centralized admin ensures company-wide standards

- • Flexible enough to work with existing processes

"The best part about Concord is it's so flexible. We didn't have to go through a huge change in process. The subsidiary functionality is super important for us." — Sarah Eisenhauer, Director of Bids, Proposals, and Pricing

Core capabilities of modern contract compliance platforms

Modern contract compliance software offers a comprehensive set of capabilities designed to streamline compliance monitoring, automate routine tasks, and provide actionable insights for strategic decision-making.

Obligation extraction and tracking

At the heart of compliance management is the ability to identify, extract, and track obligations from complex agreements. Advanced platforms leverage AI and natural language processing (NLP) to automatically identify:

- Performance requirements and deliverables

- Service level agreements (SLAs) and metrics

- Payment terms and financial obligations

- Regulatory compliance requirements

- Security and data protection standards

- Reporting and notification obligations

Michael Bearman, Chief Legal & Safety Officer at Vecna Robotics, describes the impact of AI-powered obligation tracking: "I used to have to spend lots of time on this, but now I just hit 'create document' because the AI does a great job automatically. Before we'd make errors like missing key dates or transposing numbers, which caused problems down the line. Now, with Concord, that information is automatically captured and validated, so we can trust its accuracy."

Risk identification and mitigation

Modern compliance platforms go beyond basic obligation tracking to provide sophisticated risk monitoring capabilities. These systems can:

- Score contracts based on risk factors

- Flag non-standard or potentially problematic clauses

- Compare agreement terms against regulatory requirements

- Identify potential conflicts between contracts

- Monitor vendor compliance with security and performance standards

- Alert stakeholders to potential compliance issues before they escalate

Research from Aberdeen Group indicates that organizations with advanced contract compliance capabilities experience 55% fewer contract disputes and significantly reduce their exposure to regulatory penalties.

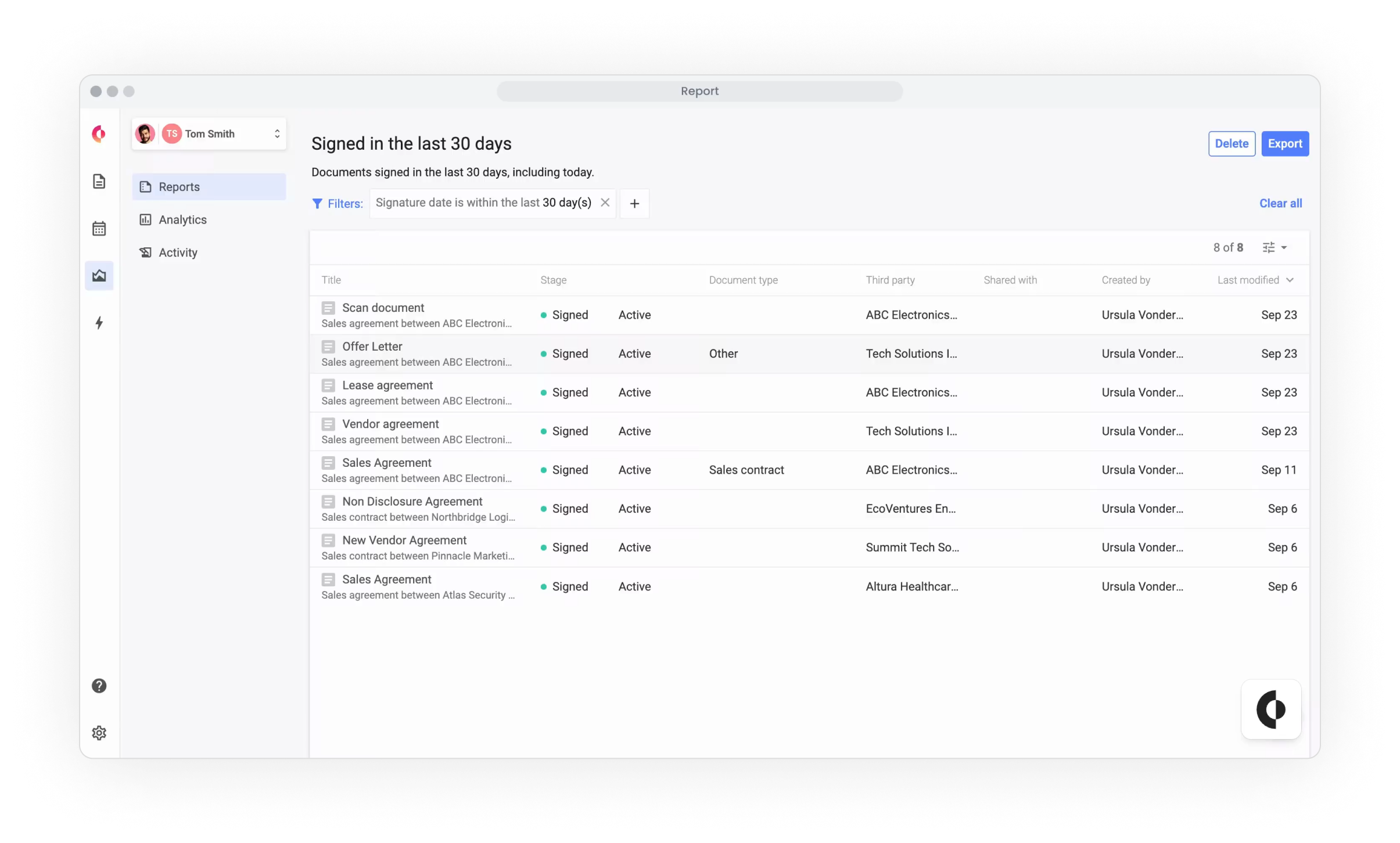

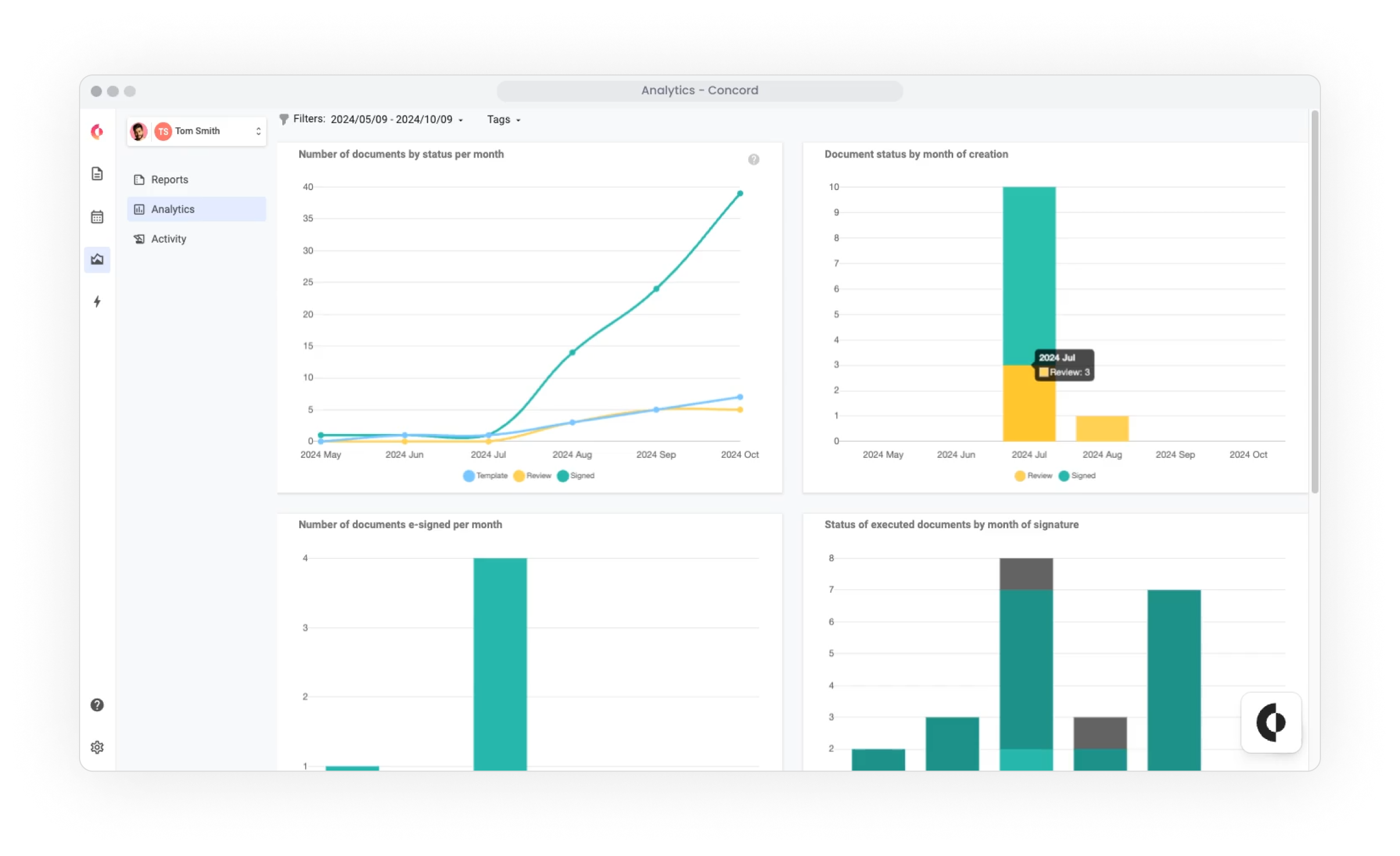

Performance monitoring and reporting

Effective compliance management requires continuous monitoring of performance against contractual obligations. Leading platforms provide:

- Real-time dashboards showing compliance status across contract portfolios

- Automated reporting on key performance indicators (KPIs)

- Variance analysis highlighting deviations from expected performance

- Supplier scorecards and performance tracking

- Compliance certification management

- Audit trails documenting compliance activities

The ability to generate comprehensive compliance reports on demand has become particularly valuable as regulatory scrutiny intensifies. Organizations can now provide evidence of compliance efforts much more efficiently, reducing the burden of regulatory audits.

Financial optimization capabilities

Beyond risk mitigation, modern compliance management solutions help organizations optimize the financial performance of their contracts through:

- Automated validation of pricing terms and invoices

- Spend analysis and contract utilization tracking

- Identification of volume-based discount opportunities

- Recognition of price escalation and renewal opportunities

- Detection of billing errors and overcharges

- Analysis of contract performance against financial targets

These capabilities can deliver substantial ROI. According to a study by McKinsey, organizations that implement robust contract compliance programs capture an average of 5-10% in additional value from supplier agreements alone.

| Term | Definition (May 2025) |

|---|---|

| Contract Compliance | The process of ensuring all parties fulfill their contractual obligations and adhere to agreed terms, timelines, and regulatory requirements |

| Obligation Extraction | The automated identification and tracking of specific responsibilities, deadlines, and requirements within contract language |

| AI-Powered Analytics | The use of artificial intelligence to analyze contract data, identify patterns, predict outcomes, and provide actionable insights |

| Contract Lifecycle Management (CLM) | The comprehensive process of managing contracts from initiation through execution, compliance monitoring, and renewal |

| SLA Compliance | Adherence to service level agreements that define performance metrics, response times, and quality standards |

The transformative impact of AI on compliance management

Current AI capabilities in compliance monitoring

Artificial intelligence has dramatically transformed contract compliance management, enabling levels of automation and insight previously impossible. The current generation of AI-powered compliance tools leverages several key technologies:

- Natural Language Processing (NLP): Automatically identifies and classifies contractual obligations

- Machine Learning (ML): Recognizes patterns and anomalies across contract portfolios

- Optical Character Recognition (OCR): Extracts data from scanned documents and legacy contracts

- Predictive Analytics: Forecasts potential compliance issues based on historical patterns

- Semantic Analysis: Understands contextual meaning and intent in contractual language

These technologies are revolutionizing compliance management in several key ways:

| Capability | Traditional Approach | AI-Enhanced Approach | Business Impact |

|---|---|---|---|

| Obligation identification | Manual review by legal staff | Automated extraction with 90%+ accuracy | 75% reduction in review time; more comprehensive coverage |

| Risk assessment | Standardized risk scoring based on contract type | Dynamic risk analysis based on specific clause language and context | Earlier identification of high-risk provisions; more nuanced risk management |

| Performance monitoring | Periodic manual audits | Continuous automated monitoring with real-time alerts | 65% increase in SLA compliance; faster remediation of issues |

| Financial validation | Sample-based invoice auditing | Comprehensive verification of all financial terms | 2-5% recovery of contract value through error detection |

| Regulatory compliance | Checklist-based verification | Automated comparison against current regulatory standards | 80% reduction in compliance verification effort; lower regulatory risk |

As Pepe Carr, General Counsel at Sand Technologies, observes about AI's role: "If your learning model can raise their hand and say, 'I don't know what this is, please take a look,' then you are off to reduce legal headcount." This highlights the value of "human-in-the-loop" systems, where AI assists legal professionals by flagging potential issues for review rather than making final decisions autonomously.

Limitations and considerations

While AI has transformed compliance management, important limitations remain. Tammy Carroll, Contract and Strategy Manager at OneCare Vermont, emphasizes: "You still need a human." This reflects the understanding that AI should be seen as a tool to augment, not replace, human judgment.

Current limitations include:

- Contextual understanding: AI may miss nuanced obligation language requiring industry-specific knowledge

- Regulatory interpretation: Complex regulatory requirements often require human expertise to interpret correctly

- Novel situation handling: Unprecedented compliance scenarios may not be recognized by models trained on historical data

- Semantic ambiguity: Contractual provisions with deliberate ambiguity present challenges for AI interpretation

- Relationship factors: The human aspects of business relationships that affect compliance enforcement remain difficult to quantify

These limitations underscore the importance of combining AI capabilities with human oversight in compliance management programs.

Integration: Creating a unified compliance ecosystem

The challenge of compliance data fragmentation

The concept of a "single source of truth" for compliance data remains elusive for many organizations. Concord's 2024 survey found that 75% of finance and operations leaders acknowledge significant challenges in creating truly integrated compliance information systems.

David Morgan, CFO at Loop Returns, illustrates this challenge when he describes how his team often has to "crack open the PDF" to find critical compliance information because data doesn't sync properly between systems. This manual reconciliation process introduces inefficiency and potential for error.

Building integrated compliance workflows

Modern compliance management platforms address fragmentation through robust integration capabilities that connect contract information with related business systems:

- ERP integration: Synchronizes financial obligations with payment and procurement systems

- CRM integration: Links customer agreements with relationship management data

- HRMS integration: Connects employment contracts with personnel systems

- Supply chain systems: Coordinates vendor agreements with logistics and inventory management

- Regulatory databases: Updates compliance requirements based on changing regulations

- Risk management systems: Incorporates contract risks into enterprise risk frameworks

Christopher Tufts, FP&A Manager at Iterable, emphasizes the importance of this integration: "An integrated CLM is important so we can serve all our principal audiences from the same system."

Effective integration creates a continuous compliance monitoring environment where obligations are tracked throughout their lifecycle, from initial contract signing through performance monitoring to renewal or termination.

How to Implement Contract Compliance Management in 5 Steps

-

Assess your current compliance state (1-2 weeks)

Evaluate existing contract management processes, identify high-risk agreements, and document critical compliance requirements.

-

Select the right compliance management solution (2-4 weeks)

Evaluate platforms based on AI capabilities, integration potential, usability, and alignment with your specific industry requirements.

-

Import and analyze your contract portfolio (2-3 weeks)

Centralize all agreements in your new platform, categorize by risk level, and use AI to extract key obligations and deadlines.

-

Implement monitoring workflows (3-4 weeks)

Create automated alert systems, establish approval processes, and set up performance dashboards to track compliance status.

-

Train stakeholders and refine processes (Ongoing)

Provide comprehensive training for all users, gather feedback, and continuously improve your compliance management approach.

Implementing effective contract compliance management

A phased implementation approach

Successfully implementing contract compliance management requires a strategic, phased approach that balances immediate needs with long-term objectives:

Phase 1: Foundation building (1-3 months)

- Conduct a compliance risk assessment: Identify high-priority contracts and critical compliance requirements

- Establish compliance governance: Define roles, responsibilities, and escalation procedures

- Implement basic tracking: Start with critical obligations and deadlines for highest-risk agreements

- Document current processes: Map existing compliance workflows as a baseline for improvement

Phase 2: Scaling capabilities (3-6 months)

- Deploy technology solution: Implement compliance management software with appropriate integrations

- Migrate existing contracts: Import and analyze current contract portfolio

- Establish monitoring protocols: Define performance indicators and monitoring frequencies

- Train stakeholders: Develop competencies across business units

Phase 3: Advanced capabilities (6+ months)

- Implement predictive analytics: Move from reactive to proactive compliance management

- Automate remediation workflows: Create standardized processes for addressing compliance issues

- Integrate with enterprise risk management: Incorporate contract compliance into broader risk frameworks

- Measure and optimize performance: Track compliance metrics and continuously improve processes

Key success factors

Organizations that successfully transform their contract compliance capabilities share several common practices:

- Executive sponsorship: Senior leadership commitment to compliance transformation

- Cross-functional approach: Involvement from legal, finance, operations, and business units

- Balance of technology and process: Recognition that software alone cannot solve compliance challenges

- Clear metrics and accountability: Defined KPIs to measure compliance performance

- Continuous improvement mindset: Regular review and refinement of compliance processes

Evaluating contract compliance management solutions

Key selection criteria

When evaluating compliance management platforms, organizations should consider:

- AI capabilities: Accuracy of obligation extraction and risk identification

- Integration potential: Ability to connect with enterprise systems

- Usability: Intuitive interfaces for legal and business users

- Configurability: Adaptability to specific industry requirements

- Scalability: Capacity to grow with organizational needs

- Security: Data protection and access control features

- Reporting: Comprehensive compliance status visibility

- Vendor stability: Provider's market position and development roadmap

The Concord advantage in compliance management

Concord's Agreement Intelligence platform offers several distinctive advantages for organizations seeking to enhance their compliance capabilities:

- AI-powered obligation extraction: Automatically identifies and classifies compliance requirements

- Intuitive compliance dashboards: Provides at-a-glance visibility into compliance status

- Flexible workflow automation: Adapts to organization-specific compliance processes

- Robust integration capabilities: Connects with CRM, ERP, and financial systems

- Comprehensive audit trails: Documents all compliance-related activities

- Automated alerts and notifications: Ensures timely response to compliance deadlines

As Jamie Garfield, VP of Sales at PAAY, observes: "Concord has just been great for us. We adore the AI features. There's no other contract platform that delivers this much value at this price point. Period."

| Feature | Concord | DocuSign CLM | Ironclad |

|---|---|---|---|

| Starting Price (2025) | $399/month (5 users) | $39/feature/month | Custom pricing |

| AI Obligation Extraction | Yes - Agreement Intelligence™ | Yes - Limited | Yes - Advanced |

| Native E-Signature | Yes - Unlimited | Yes - Core product | No - Requires 3rd party |

| Workflow Automation | Yes - Unlimited custom workflows | Yes - Complex setup | Yes - No-code designer |

| Implementation Complexity | Low - Days to weeks | High - Weeks to months | High - Months |

| Contract Editing | Native + MS Word + Google Docs | Limited native editing | Advanced in-app editor |

| CRM Integration | Salesforce, HubSpot, + 5000 via Zapier | Salesforce focused | Limited selection |

| Mobile Access | Full functionality on all devices | Limited mobile features | Yes - Mobile optimized |

| Customer Support | 24/7 with dedicated success manager | Limited hours, tiered support | Business hours support |

| Best For | Businesses of all sizes seeking ease of use and quick ROI | Large enterprises with complex requirements | Tech-focused companies with advanced needs |

Frequently Asked Questions

What is contract compliance management software and why is it important?

Contract compliance management software automates the tracking and monitoring of contractual obligations to ensure adherence to agreements. Organizations lose an average of 9.2% of contract value due to poor compliance management, making this software essential for minimizing risk, maintaining regulatory compliance, and maximizing financial performance.

How does contract compliance management software identify and track obligations?

Contract compliance management software uses AI and natural language processing to automatically extract and track performance requirements, service level agreements (SLAs), payment terms, regulatory compliance requirements, security standards, and reporting obligations. This eliminates manual review processes and reduces the risk of missing critical deadlines.

Can contract compliance management software integrate with existing business systems?

Yes, modern contract compliance management software offers robust integration capabilities with ERP systems for financial obligations, CRM platforms for customer agreements, HRMS for employment contracts, supply chain systems for vendor management, and regulatory databases for compliance updates. This creates a unified compliance ecosystem.

What AI capabilities does contract compliance management software provide?

Contract compliance management software leverages natural language processing for obligation identification, machine learning for pattern recognition and anomaly detection, optical character recognition for legacy document processing, predictive analytics for forecasting compliance issues, and semantic analysis for understanding contractual intent and context.

How much can organizations save with contract compliance management software?

Organizations typically achieve 25-30% reduction in contract administration costs, 75% reduction in compliance review time, 5-10% additional value capture from supplier agreements, and 55% fewer contract disputes. The software also delivers 65% increase in SLA compliance and 2-5% recovery of contract value through error detection.

What types of compliance risks can contract compliance management software help identify?

Contract compliance management software can score contracts based on risk factors, flag non-standard clauses, compare terms against regulatory requirements, identify conflicts between contracts, monitor vendor compliance with security standards, and alert stakeholders to potential issues before they escalate into costly problems.

How does contract compliance management software support regulatory compliance?

Contract compliance management software automates comparison against current regulatory standards, provides comprehensive audit trails, generates compliance reports on demand, tracks compliance certifications, and documents all compliance activities. This reduces regulatory verification effort by 80% while lowering regulatory risk exposure.

What implementation approach works best for contract compliance management software?

Successful implementation follows a three-phase approach: Phase 1 (1-3 months) focuses on compliance risk assessment and basic tracking, Phase 2 (3-6 months) deploys technology solutions and monitoring protocols, and Phase 3 (6+ months) implements predictive analytics and automated remediation workflows for advanced compliance capabilities.

About Concord: Concord empowers growing businesses to make smarter operational decisions by unlocking actionable insights from all their contracts using Agreement Intelligence. Trusted by over 1,500 companies and 1 million users worldwide, Concord enables people to swiftly sign agreements and easily access crucial business data. www.concord.app

THE PROBLEM CONCORD SOLVES

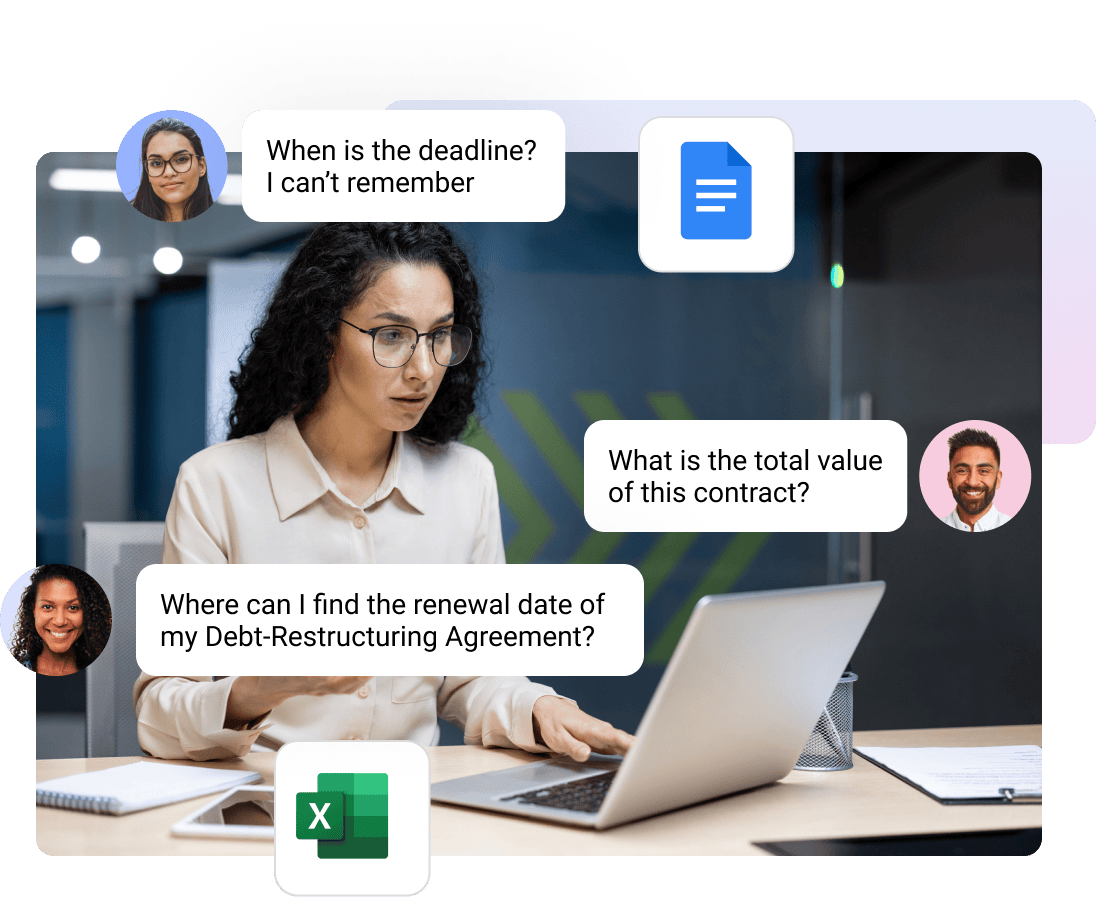

Managing contracts is difficult because they can be scattered across different places: emails, cloud drives, personal drives, and even paper copies.

Many companies rely on spreadsheets to store contract details like lifecycle dates and total contract value, but these spreadsheets don’t provide a full view of the contract, and it’s tedious to keep updated.

When contracts are saved on personal drives, critical information—like renewal dates and deadlines—is hidden from the rest of the team. This can cause headaches for audits.

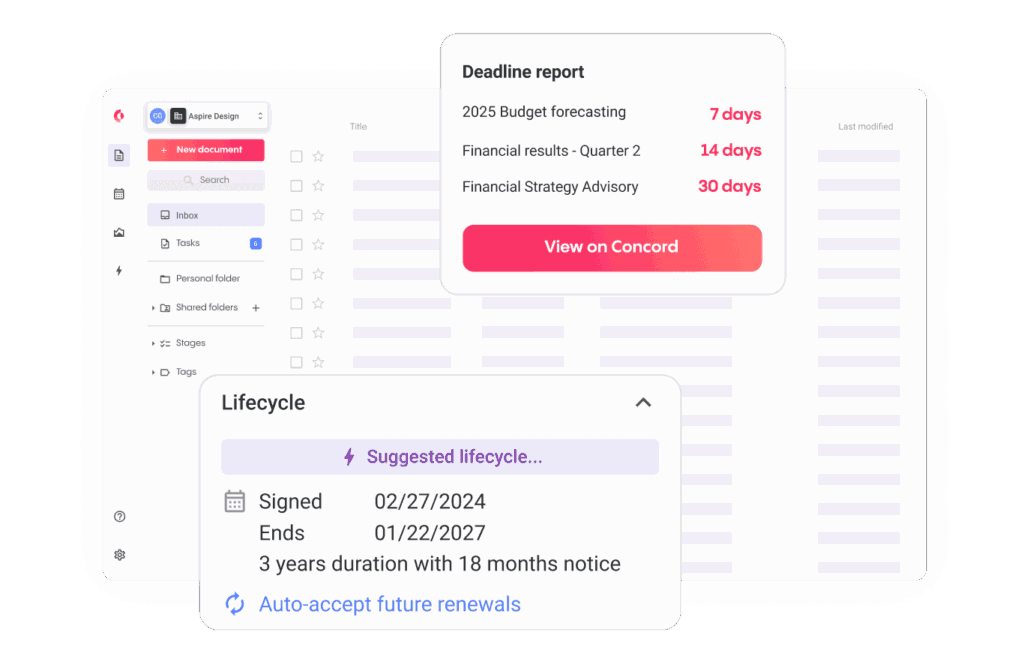

If a renewal date is missed, contracts may auto-renew without the chance to renegotiate terms, potentially locking the company into bad deals.

Worse, important contracts could expire without notice, leading to service disruptions, penalties, or lost business opportunities.

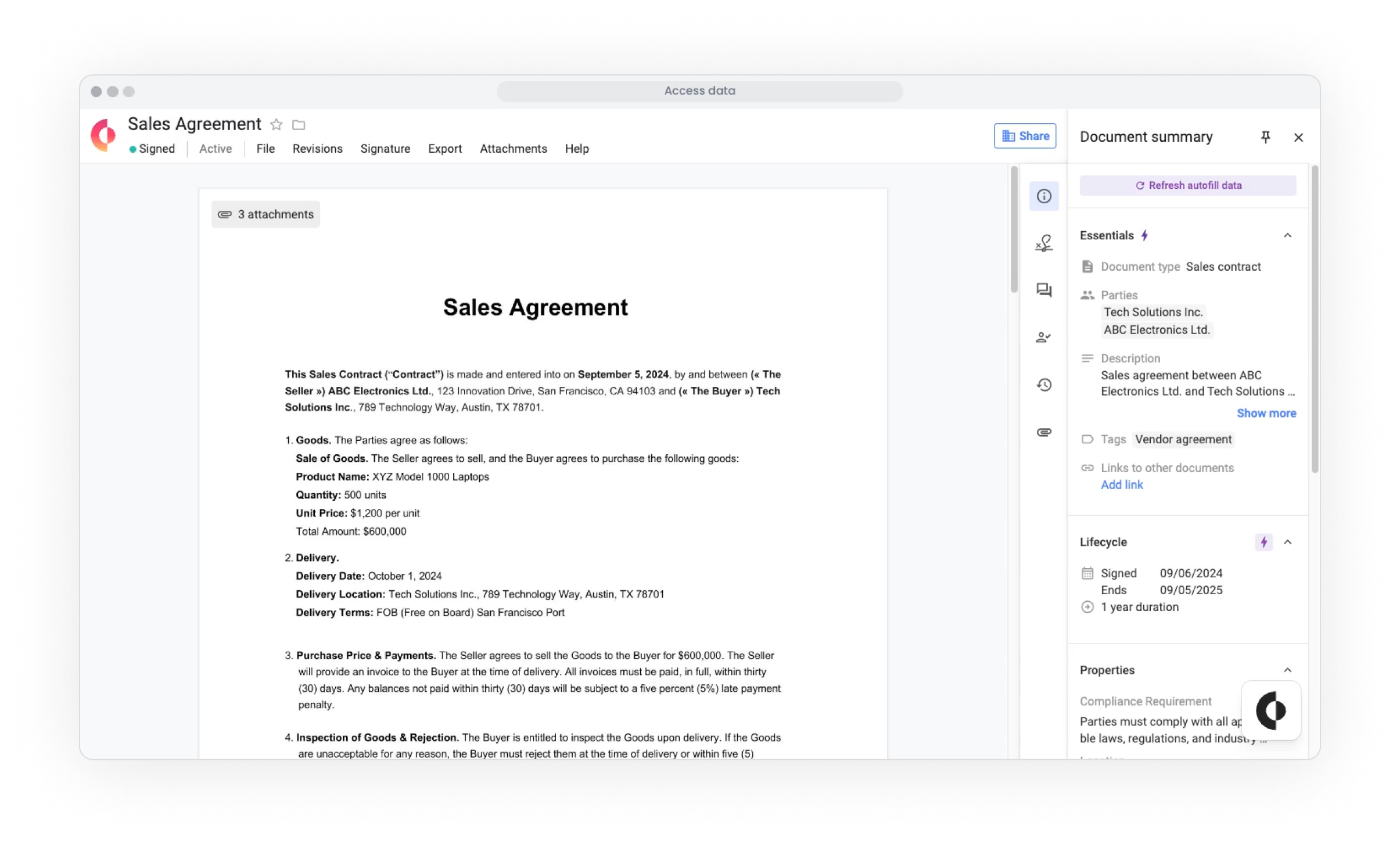

CONCORD'S SOLUTION

With Concord's agreement intelligence, each step after the signature becomes an opportunity to gain insight, act strategically, and ensure compliance.

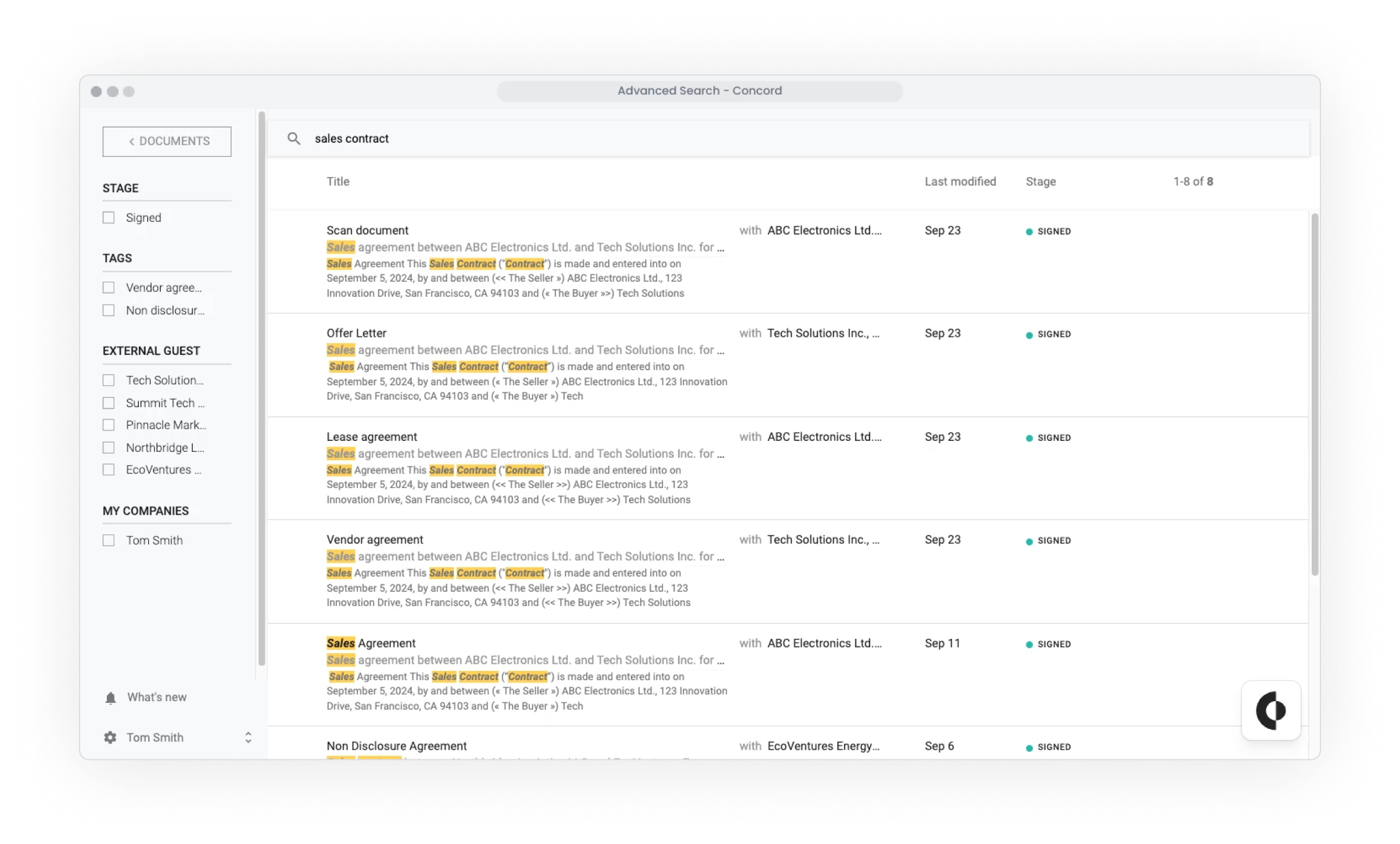

Instead of spending time and resources tracking down individual agreements or manually searching for specific terms, companies have instant access to the critical information they need.

This not only reduces missed renewals and enables smarter vendor management but also allows the business to make data-driven decisions that were previously out of reach.

Ultimately, agreement intelligence is more than a simple upgrade to contract storage. It represents a shift in how contracts support the business, transforming them from static documents into powerful tools that can guide strategy and fuel growth.

Automated processes

contracts are managed via automated workflows, all in one intuitive platform

Manual processes

contracts have to be managed manually, across many platforms

Full visibility into contracts

the finance team can quickly search all contracts and get email updates

Limited visibility into contracts

the finance team lacks insight into contract amounts and other key terms

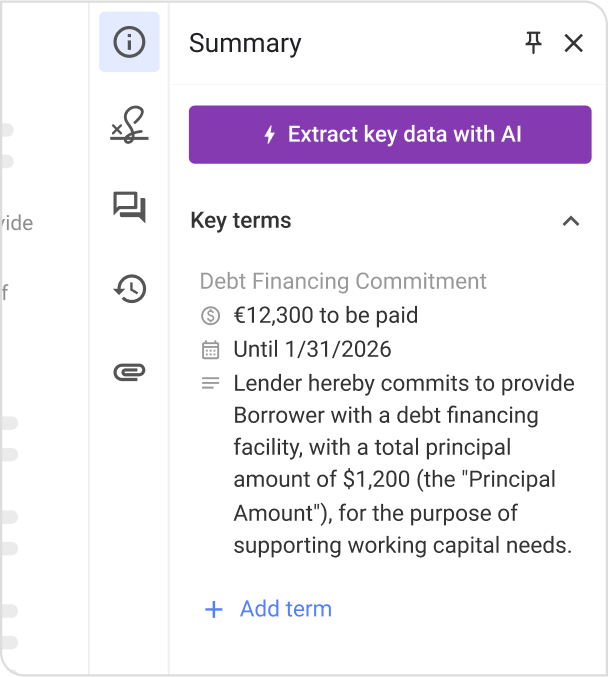

AI-powered data extraction

Agreement Intelligence extracts all contract terms automatically

Time-consuming data collection

forecast data has to be entered by hand, requiring hours of labor

Get deep visibility into all the agreements you sign

Concord extracts deadlines, dollar amounts, and other key terms from MS Word docs, Google Docs, and PDFs — plus contracts signed in PandaDoc, DocuSign, Icertis, and more.

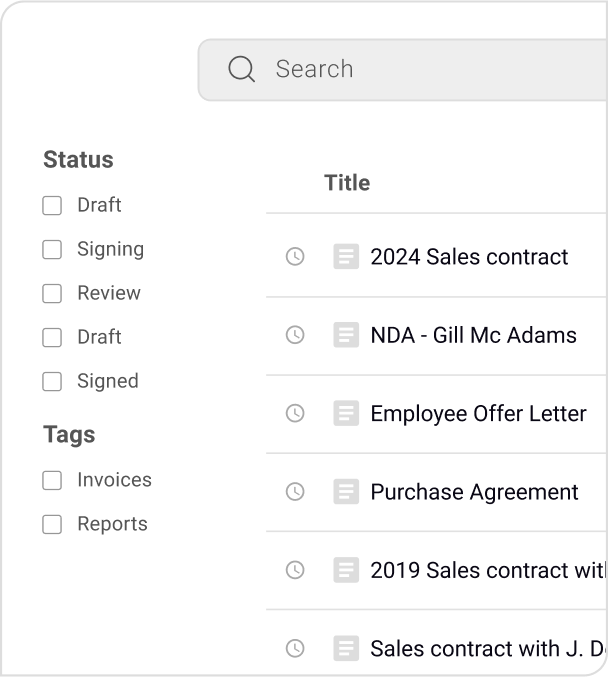

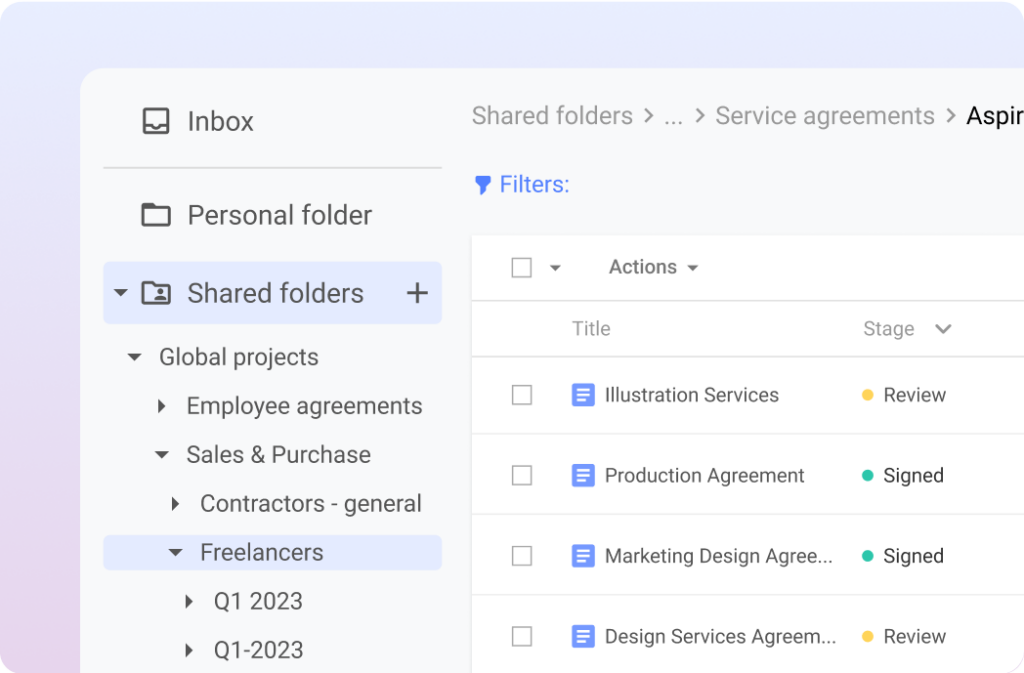

One place for all your contracts

Unlimited storage

Store every contract, securely, without worrying about limits

Custom permissions

Control who accesses each document with custom permission settings

Smart Search

Find any contract instantly with powerful search and filtering tools

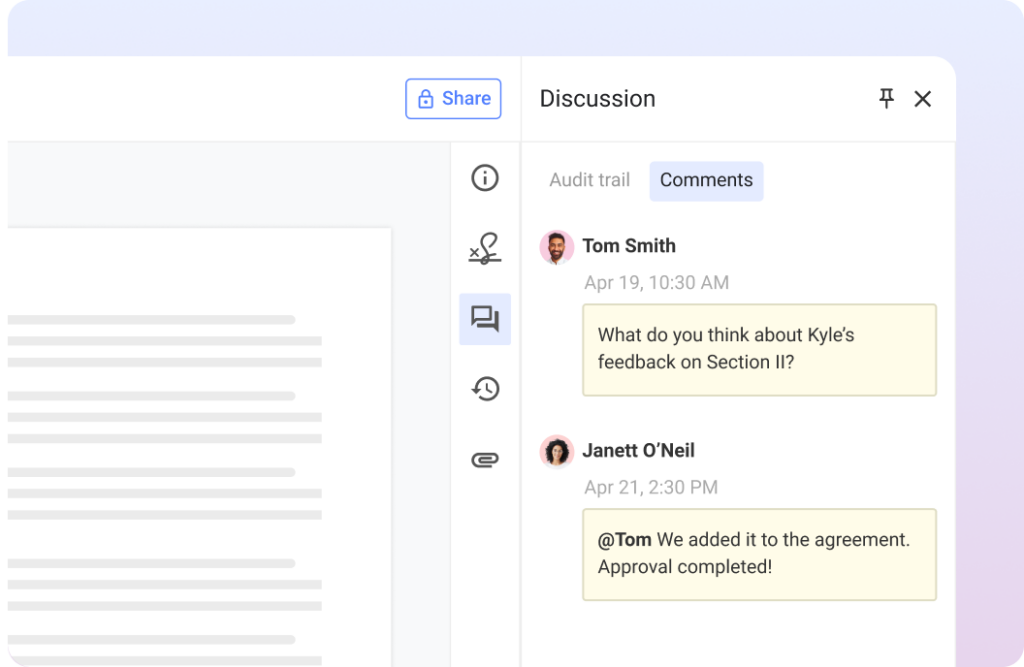

Real-Time Collaboration

Work together seamlessly with team members, regardless of location or department

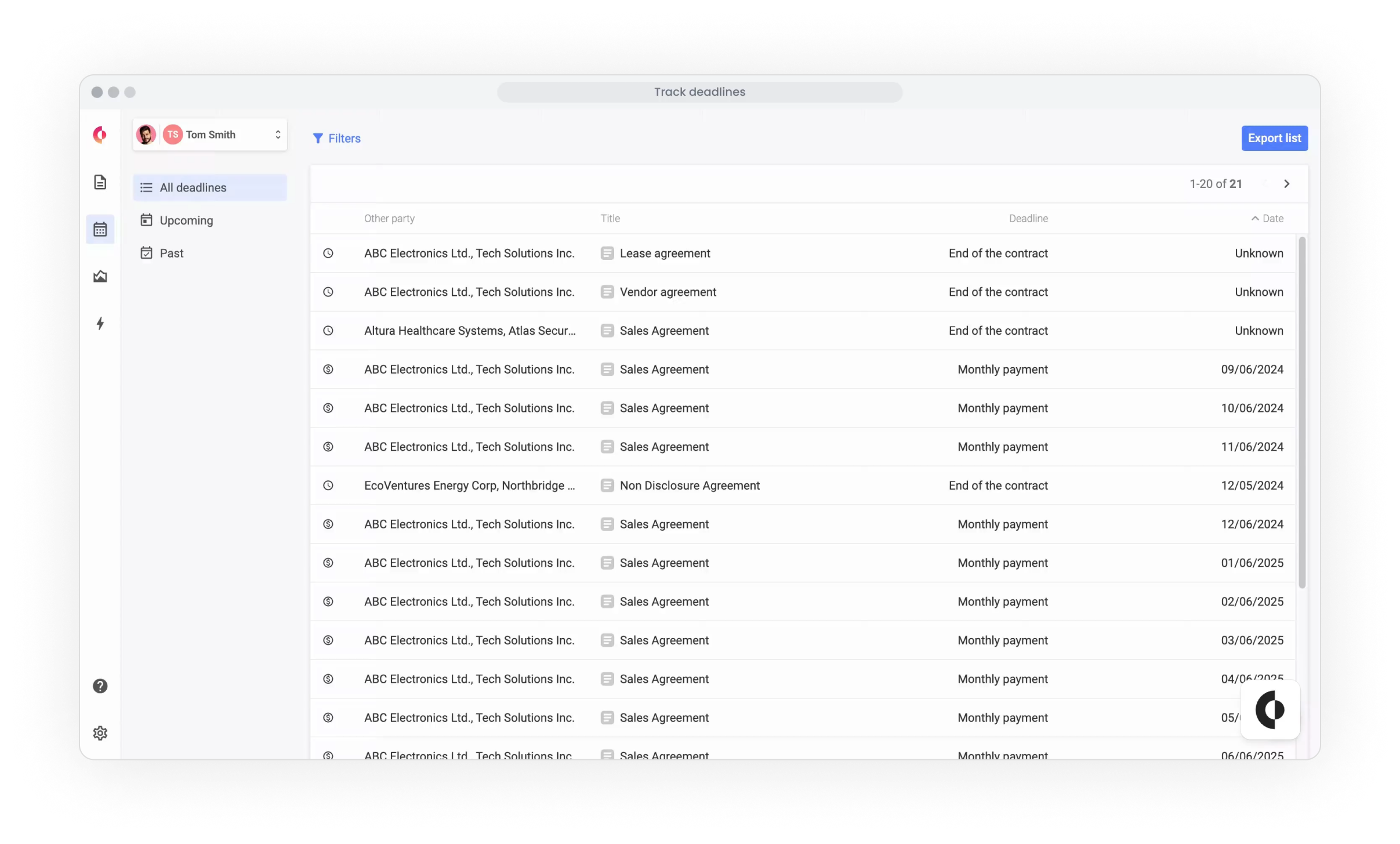

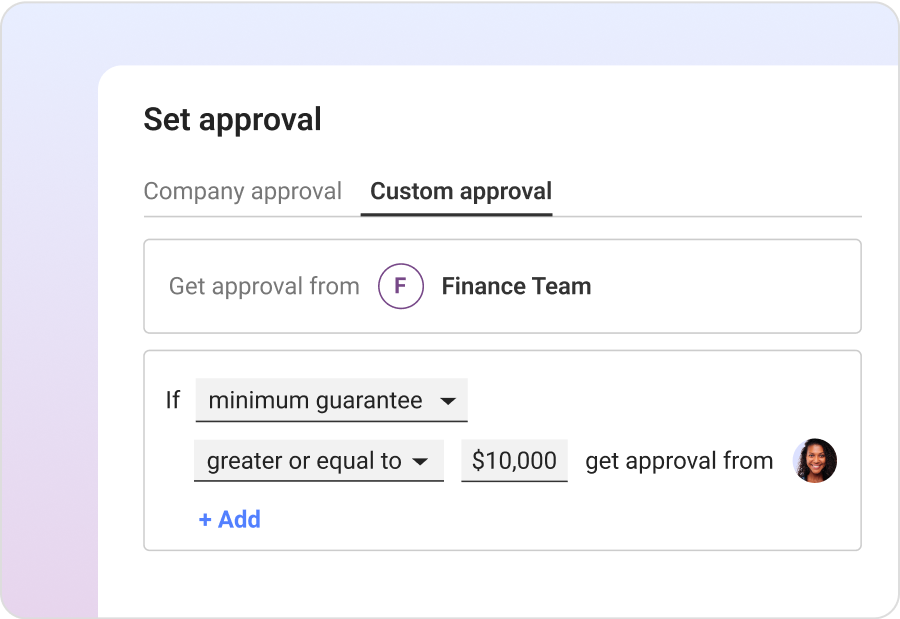

Automate the contract lifecycle with contract compliance management software

Unlimited Approval Workflows

Set up unlimited approval workflows for every type of contract

Deadline Reminder Notifications

Never miss another renewal date or approval with smart alerts

The highest level of security for your contracts

Enterprise-grade Security

Concord implements enterprise-grade measures, including SOC 2 Type II certification, GDPR compliance, and a Star Level One rating from the Cloud Security Alliance.

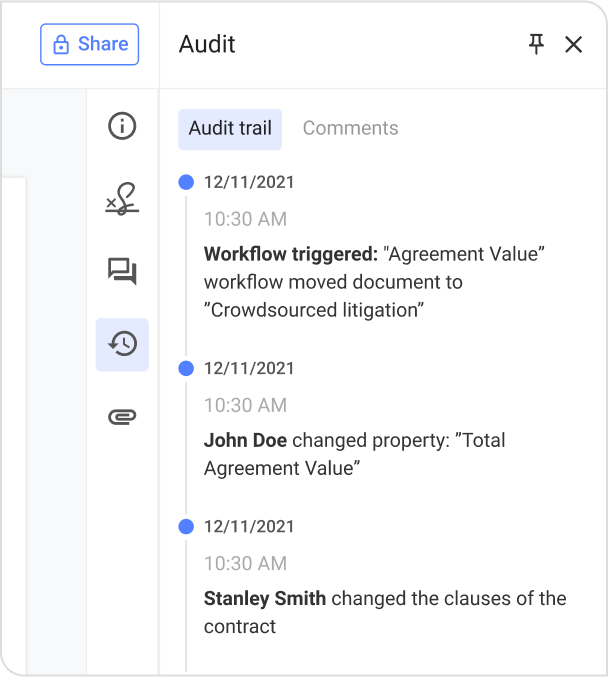

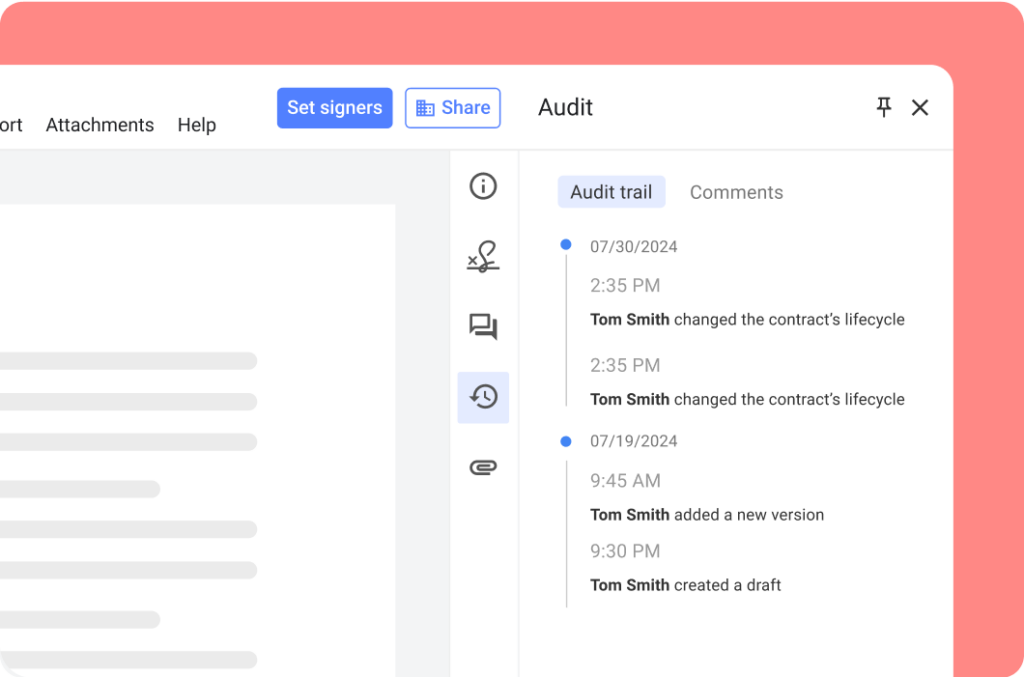

Audit Trail

Track every interaction with contracts for complete

transparency and accountability

Contract analytics software that easily connects to your existing stack

CRM integration

Create contracts that auto-fill with data from your CRM deals – then share, negotiate, and sign them in

Concord

Zapier

Connect with over 5,000 apps to automate workflows across platforms

Thousands of labor hours saved for teams around the globe

“Concord knows exactly what data I want, before I even ask for it. It thinks for me.”

Ramola Khushlani

Contract Manager at Workspend

“The velocity of our organization has improved dramatically since we’ve adopted Concord.”

Peter Koutromanos

CEO at Avior Capital

-20%

Less time spent searching for contract terms every day